This year's sharp decline in consumer electronics has driven the market for a large number of components to weaken, including DRAM memory and NAND flash memory. As a typical representative of "long material", memory did not show much performance in the previous tide of core shortage, but now the industrial demand is sharply reduced, and the market is "a thousand miles away".

Based on the market data of flash memory market, Jibang Technology and other institutions, the representative DDR4 8Gb memory in DRAM market has declined by about 20% in the past half year, and SSD, eMMC, UFS and other categories in NAND flash memory market have also generally increased by 20% to 30%. As the destocking of the industrial chain is still not optimistic, the decline of DRAM and NAND flash memory in the fourth quarter will exceed the original expectation.

The market is not improving, and major manufacturers have also tightened their expectations and production expansion plans. Micron announced in late September that it will reduce the production of DRAM and NAND flash memory, and will delay the launch of 232 layer NAND flash memory products. It is expected that 176 layer will still be the main process next year. Immediately after that, Armour Xia also announced to reduce the utilization rate of NAND flash memory capacity by 30% from October, and its partner WD will also significantly reduce the proportion of 162 layers of NAND flash memory, which will still be dominated by 112 layers of products next year.

Among Korean manufacturers, SK Hynix has recently significantly revised its capital expenditure quota for 2023, reportedly cutting more than 70% of its orders to equipment manufacturers. Although Samsung disclosed that its operating profit in the third quarter would be cut by 30%, it has no plan to cut production capacity so far, which seems to be a counter cyclical investment to the end.

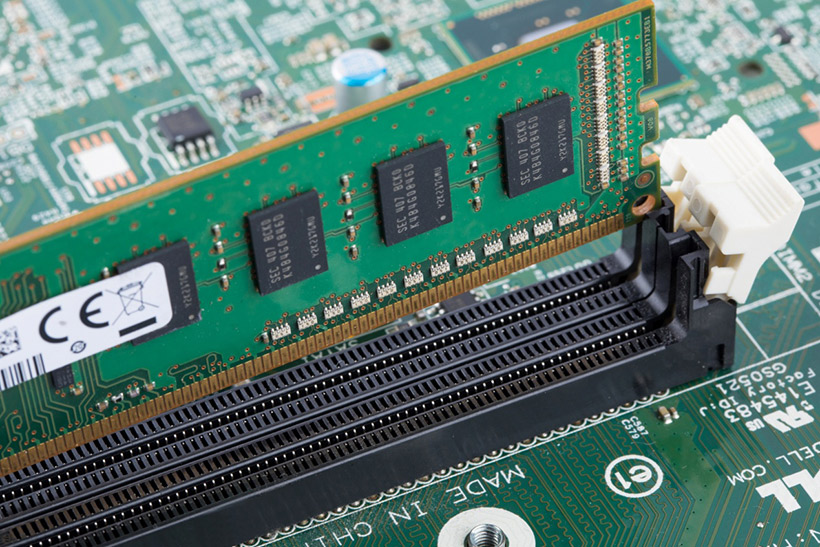

At present, the industrial chain is trying to de inventory whether it is terminals, distribution channels or the original factory, but the source of storage supply is determined by the original factory. On the aspect of quantity, the original factory expanded production and made a sudden brake to avoid producing more inventory; In terms of price, the original factory will "exchange price for quantity" regardless of cost, and strive to stimulate the willingness to stock up downstream. For downstream module manufacturers and terminal manufacturers, the cost of goods preparation can be reduced, and the pressure will be eased.

Memory falling price, downstream terminals and module factories benefit

For module manufacturers, the price reduction of the original memory factory is conducive to the reduction of production costs, thus promoting performance growth. At present, the industry expects that the DRAM market will reach the bottom earlier than NAND flash memory, while the revenue of memory module factories such as Weigang and Yuzhan will gradually increase in the third quarter. In contrast, the revenue of Nanya Branch, the upstream memory factory, has been declining all the time. In September, the revenue even fell by more than 50% year on year, and the fourth quarter will continue to decline.

In the NAND flash memory market, the main control factory group said that all the original factories are facing the pressure of loss. The market price of NAND flash memory may have fallen below the manufacturing cost or even the cash cost, so the subsequent decline will gradually narrow, and the worst situation of the market will pass. From this year to September, the shipment of the PCIe SSD master of the group increased by more than 26%, indicating that the original flash memory factory had not reduced the supply before.

In the context of high inventory in the whole industrial chain, the original factory must offer lower supply prices to stimulate the willingness of downstream to stock up more or less, and the cost is to give up the growth of revenue and profits. According to past experience, the falling price of memory will also stimulate terminal manufacturers to improve the storage capacity of their products. However, this year's consumer market is basically a pattern of "low peak season". The effectiveness of inventory up and down the industrial chain depends more on whether the macro situation is favorable.

Where will the market go in the future?

For the future market, the industry's more pessimistic expectations show that the market has entered an "L-shaped" bottom posture, and the price decline will continue to the first half of 2023; The optimistic expectation indicates that after the inventory digestion in the second half of this year, it will return to a healthy state in the first half of 2023.

The consensus of the above two expectations is that this year will be within the scope of inventory adjustment, and the expectation of the completion time of inventory adjustment next year reflects the judgment of all parties on the macro situation. However, with the development of electronic technology, the amount of memory used by various consumer products, automobiles and industrial equipment will always increase. We can be optimistic about the long-term development of the storage industry.